Program Content for the Master in Finance

The Master in Finance (Diplôme Spécialisé en Finance) is authorized by the French Ministry of Higher Education, Research and Innovation to award a recognized BAC+5 degree, Master’s Grade, to its students. Our Master in Finance program has been accredited for a four-year period after a rigorous assessment by the National Management Programmes Assessment Commission (CEFDG).

Step into a program designed to launch your career in the dynamic and demanding world of investment banking, whether in Corporate Finance or Financial Markets.

Keys points

The Master in Finance is designed to offer students all the soft/hard skills and know-how needed to excel in the investment banking:

- Diversity: the Master in Finance offers a diverse environment through its cohort (nationalities, genders, backgrounds, etc.).

- A mix between academic (20 faculty professors) and professional lecturers (90) to ensure the best learning environment

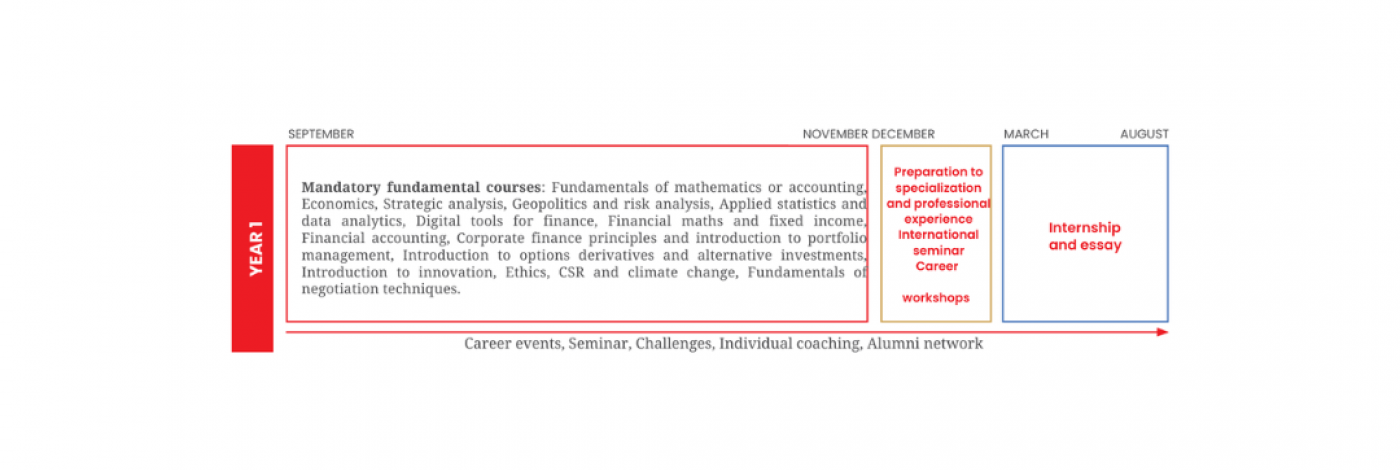

- A 2-year program structure: a common track in Year 1 and specialization in either Financial Markets or Corporate Finance in Year 2. For students who enter the program in Year 1, this structure allows them to discover in depth financial applications before committing to a specialization

- emlyon’s distinctive academic signature: learning as not only a transfer of academic knowledge but also a "course of learning experiences" that equips students to forge a constant link between thought and action: "doing to learn, learning to do".

- Financial Challenges: Students will be able to take part in French or international challenges or more in the financial field (e.g.: ARE, Trophée des futures licornes, BBG, CFA in Corporate Finance and Financial Markets.

- Professional certifications: Students will also acquire the necessary skills to take different certificates: AMF, CFA 1 and 2, Bloomberg Certification.

- Summer internship preparation: To maximise your chances to get a coveted summer internship at a bulge bracket banks during your program, emlyon business school offers a select number of students the opportunity to be trained by our career center to the application tests (limited seats).

- Careers Forum: Students will attend a specific Finance Career Forum organized by the Career Center, as well as some dedicated conferences about Financial topics.

Discover the program content for the 2025-2026 academic year:

Academic content

Year 1

📅 September to March

📍 Lyon

Academic content and experiential elements

Mandatory fundamental courses:

- Economics and intro to financial markets

- Financial accounting

- Corporate finance principles

- Introduction to portfolio management

- Fundamentals of mathematics

- Strategic analysis

- Applied statistics,

- Fundamentals of negotiation techniques

- Financial maths

- Digital tools for finance

- Geopolitics

- Intro to data analytics

- Options and other derivatives

- Advanced fixed income

- Ethics, Compliance & Governance

- Introduction to alternative investments

Optional courses

- French for foreigners

- Certification AMF/ Bloomberg/ Prep CFA

Professional project

- International seminar (1 week)

- 4 to 6 months internship

- Career workshops

- Internship essay

📅 April to September

📍 France or international

Internship

The 4 to 6-month internship is a great opportunity to put your academic knowledge to the test and acquire tangible experience within the sector of your choice. The school will support you with individual coaching, workshops, and digital tools for you to find your internship and define your professional project

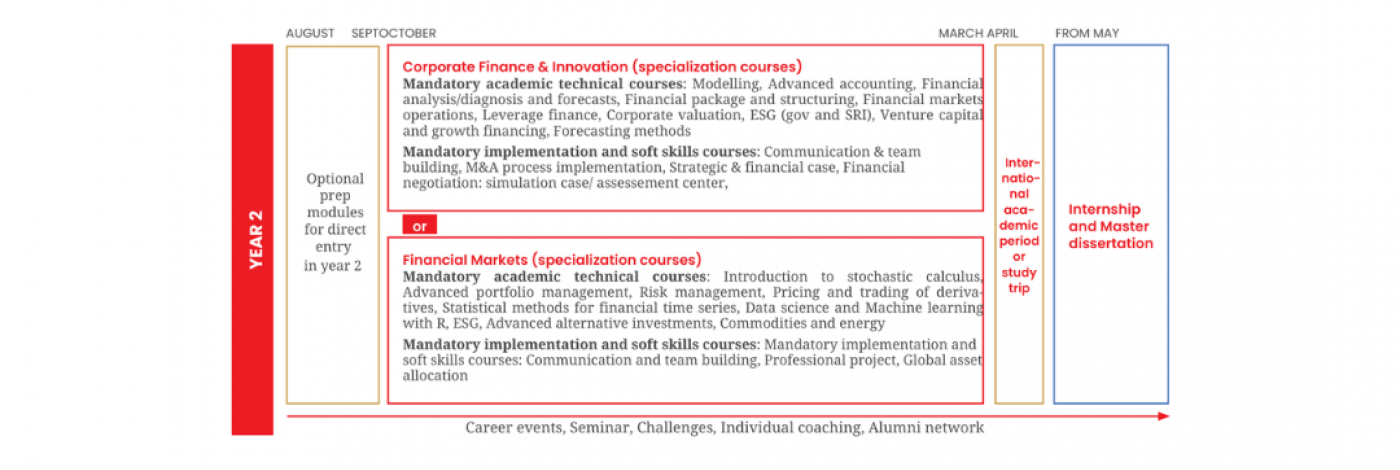

Year 2

📅 August and September

📍 Online

Optional Modules

Optional preparatory modules from year 1 are available to help all students strengthen their skills and knowledge in preparation for direct entry in the second year of the Master in Finance.

- Economics,

- Fundamentals of Mathematics,

- Financial Accounting,

- Strategic Analysis,

- Corporate Finance Principles,

- Portfolio Management,

- Advanced Fixed Income

Academic content and experiential elements

📅 October to April

📍 Lyon

Corporate Finance & Innovation (specialization courses)

Mandatory academic technical courses:

- Modelling

- Advanced accounting

- Financial analysis/diagnosis & forecasts

- Financial package and structuring

- Financial markets operations

- Leverage finance

- Corporate valuation

- ESG & Climate change

- Venture capital & growth financing

- Forecasting methods

Optional courses :

- French for foreigners

- Certification AMF/ Bloomberg/ Prep CFA

Mandatory implementation and soft skills courses :

- Management : communication & team building

- Innovation seminar

- M&A process - implementation

- Strategic & financial Case

- Financial negotiation : simulation case

- International academic period (1 month)

Professional project and research :

- Career workshops

- Methodology research

- Internship

- Master dissertation

Financial Market (specialization courses)

Mandatory academic technical courses:

- Proba & intro to stochastic calculus

- Advanced portfolio management

- Risk management 1

- Pricing and trading of derivatives

- Statistical methods for financial time series

- Risk management 2

- Intro DS + machine learning with R

- ESG & Climate change

- Advanced alternative investments

- Commodities and energy

Optional courses :

- French for foreigners

- Certification AMF/ Bloomberg/ Prep CFA

Mandatory implementation and soft kills courses :

- Management : communication & team building

- Professional project

- Global asset allocation

- International academic period (1 month)

Professional project and research :

- Career workshops

- Methodology research

- Internship

- Master dissertation

📅 April

📍 International

International period

- International period in Italy (Bocconi) or Canada (Mc Gill) - 1 month

This is an opportunity for you to discover another culture and have courses in a prestigious university outside of France. You will be confronted to a new international business environment where you will complete your technological acculturation.

📅 From June onwards

📍 Anywhere

Internship and Master dissertation

- Internship : The 4 to 6-month internship is a great opportunity to put your academic knowledge to the test and acquire tangible experience within the industry. The school will give you all the support and tools you need to find the right internship for you.

Instead of doing an internship, starting directly with your first job can validate this professional experience required to get your degree and graduate from the program.

- Master dissertation: The Master dissertation is an analytical work on a topic related to the industry and to the professional experience gained during your internship. This is a great opportunity for you to research a subject which is not only of particular interest, but which has the potential to contribute powerfully to your personal and professional development.

Assessments

Assessment methods may include case studies, presentations, mock exercises, tests, etc.

The graduation rate for students of the previous MSc in Finance for the 2021-2022 academic year was 69.4% (99.2% of students taking the exam have graduated).

News & events

See allDo you still have questions about the program? Download the brochure or contact your program advisor by accessing your account